Financial Planning

“Until you make the unconscious conscious, it will direct your life and you will call it fate.” – Carl Jung

We believe a comprehensive financial plan serves as a blueprint from which to direct your life. We work with you to develop a custom plan that incorporates a wide range of strategies based on your particular needs and goals for the future. We then regularly review and update your plan to help address the needs of your ever-evolving life.

Multi-Generational Planning

“The successful among us delay gratification and bargain with the future.” – Jordan Peterson

Many of our clients wish to provide for future generations of family members, which is why we take a multi-generational approach to financial management. But multi-generational planning is more than just estate planning. It’s also an approach to managing wealth that involves the transfer of long-term goals and family values. That’s why, when appropriate, we include younger generations in the planning process. This helps ensure your loved ones are informed about your priorities and goals.

We provide a wide range of services and support to help your children and grandchildren succeed, regardless of where they stand on their own financial journeys. We also educate the next generation to help prepare them with the knowledge they need to successfully manage your family’s wealth and pass your values along to future family members.

Retirement Planning

“The best way to measure your investing success is not by whether you’re beating the market but by whether you’ve put in place a financial plan and a behavioral discipline that are likely to get you where you want to go.” – Benjamin Graham

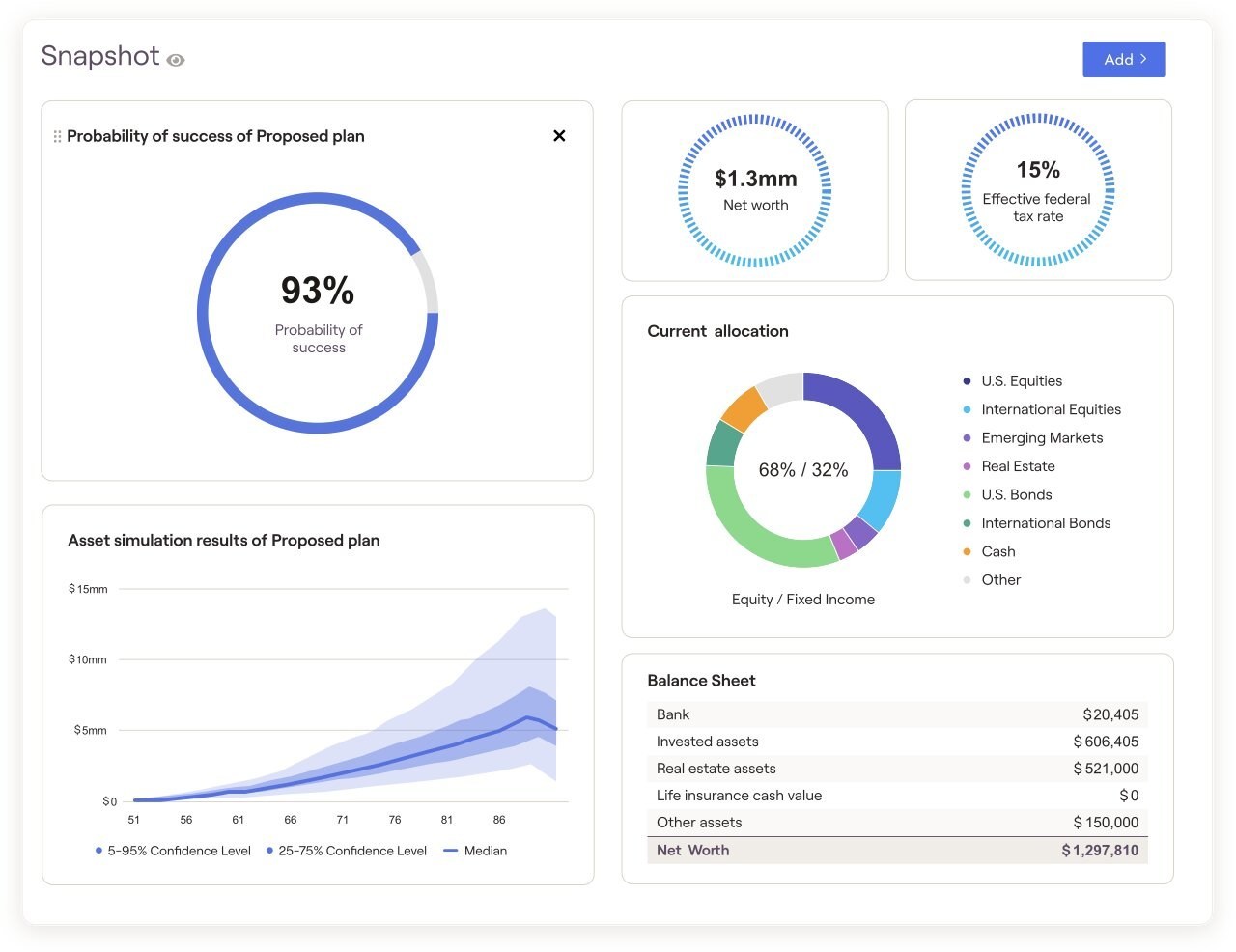

At WealthOne Advisors, we work with you to develop, implement and maintain a custom retirement plan that helps you feel more confident and in control of your financial future.

We begin by establishing a tax-efficient withdrawal strategy to support your short- and long-term needs in retirement. We conduct a thorough review of your pension and Social Security benefits to establish a distribution strategy that takes into consideration your retirement goals, life expectancy, family situation, income requirements and more.

We help you plan for any legacy goals by working with your estate planning attorney to implement any necessary legal documents and trusts. We can also help you optimize your charitable giving strategy if your goals include philanthropic objectives.

We will continue to monitor and adjust your retirement strategy throughout your lifetime to help support your ever-evolving life, retirement and legacy goals.

Our retirement planning services include:

- Roth Conversions

- 72T Distributions

- Social Security Optimization

- Required Minimum Distribution Strategies

- Legacy Planning

- Monthly Income and Cash flow Analysis and Strategies

- Savings and Investment Management Strategies

- Employee Benefits Guidance

- Tax-efficient Distribution Strategies

- Unwinding Low-basis Stock Positions

- Navigating Net Unrealized Appreciation (NUA), Restricted Stock Units (RSUs) and Employee Stock Ownership Plans (ESOPs)

Education Planning

“An investment in knowledge pays the best interest.” – Benjamin Franklin

If your goals include paying for a child or grandchild’s college education, it’s important to start planning early. Given the rapidly rising costs of higher education, you’ll want to implement a strategy to reduce your taxes and manage your saving potential. We can help with that.

While the most popular way to save for college is through a 529 college savings plan, we assess whether it also makes sense to implement a Coverdell ESA, a custodial account or a trust, based on your specific financial situation and college funding objectives. We research all options to develop an education savings plan that helps you work towards your particular goals.

Our education planning services include:

- Establishing funding strategies for 529s, UTMA/UGMA custodial accounts and/or Coverdell ESAs

- Determining how college savings accounts may impact a child or grandchild’s eligibility for financial aid

- Determining the true cost of education, factoring in all potential expenses

Tax and Estate Planning

“I resolved to stop accumulating and begin the infinitely more serious and difficult task of wise distribution.” – Andrew Carnegie

If your goals include leaving a lasting legacy for the people and causes that matter most to you, we can help you implement a tax-efficient estate planning strategy to manage your impact. In partnership with your estate planning attorney, we implement a custom estate plan that works alongside your overall financial plan and seeks to to protect your legacy while also reducing your love ones’ tax burden.

Our tax and estate planning services include:

- Working with outside legal counsel to draft and implement estate planning documents that align with each client’s overall financial goals.

- Ensuring account beneficiaries are properly documented.

- Establishing strategies to reduce the tax impact and manage the transfer of your heirs’ IRA withdrawals from inherited accounts.

- Coordinating a smooth and efficient transfer of assets following your death.

- Implementing strategies to help reduce estate taxes, including:

- Lifetime Family Giving Strategies

- Charitable Giving Strategies

- Grantor Retained Annuity Trusts (GRATs)

- Irrevocable Life Insurance Trusts (ILITs)

- Qualified Personal Residence Trusts (QPRTs)

Wealth One Advisors and LPL Financial do not provide legal or tax advice or services. Please consult your legal or tax advisor regarding your specific situation.

Investment Management

“It’s not what happens to you, but how you react to it that matters.” – Epictetus

Using your financial objectives as a guide, we develop and implement a diversified portfolio to work towards meeting your needs. We consider all of your accounts as we design a tax-efficient, low-cost portfolio that takes into account your current financial situation, future goals, time horizon, risk tolerance, and more.

As an independent advisory firm, we have no proprietary asset requirements, which means we are free to choose from a comprehensive universe of investment options. In building your portfolio, we evaluate thousands of mutual funds, stocks and ETFs to determine an asset allocation we believe has the best possible chance of helping you work towards achieving your long-term financial objectives.

We then continuously monitor and adjust your investment mix as your life and financial situation evolve over time.

Our investment management services include:

- Establishing and maintaining an investment policy statement

- Reducing costs

- Developing a custom asset allocation based on your specific goals.

- Diversifying across various investment types and asset classes.

- Establishing an appropriate level of risk/reward to help balance growth potential while reducing potential losses

- Implementing a disciplined strategy to help remove emotion from the decision-making process.

- Identifying opportunities to improve the tax efficiency of a portfolio, such as tax loss harvesting, charitable giving and asset location strategies (putting non-tax-efficient assets in tax-efficient accounts and tax-efficient assets in taxable accounts).

- Providing regular reporting on performance and progress toward your goals.

Interested in Learning More?

Contact Us to get started.