At WealthOne Advisors, we take a straightforward, well-researched approach to investment management. There are many factors we can’t control, so we focus on those we can by:

- Mitigating costs

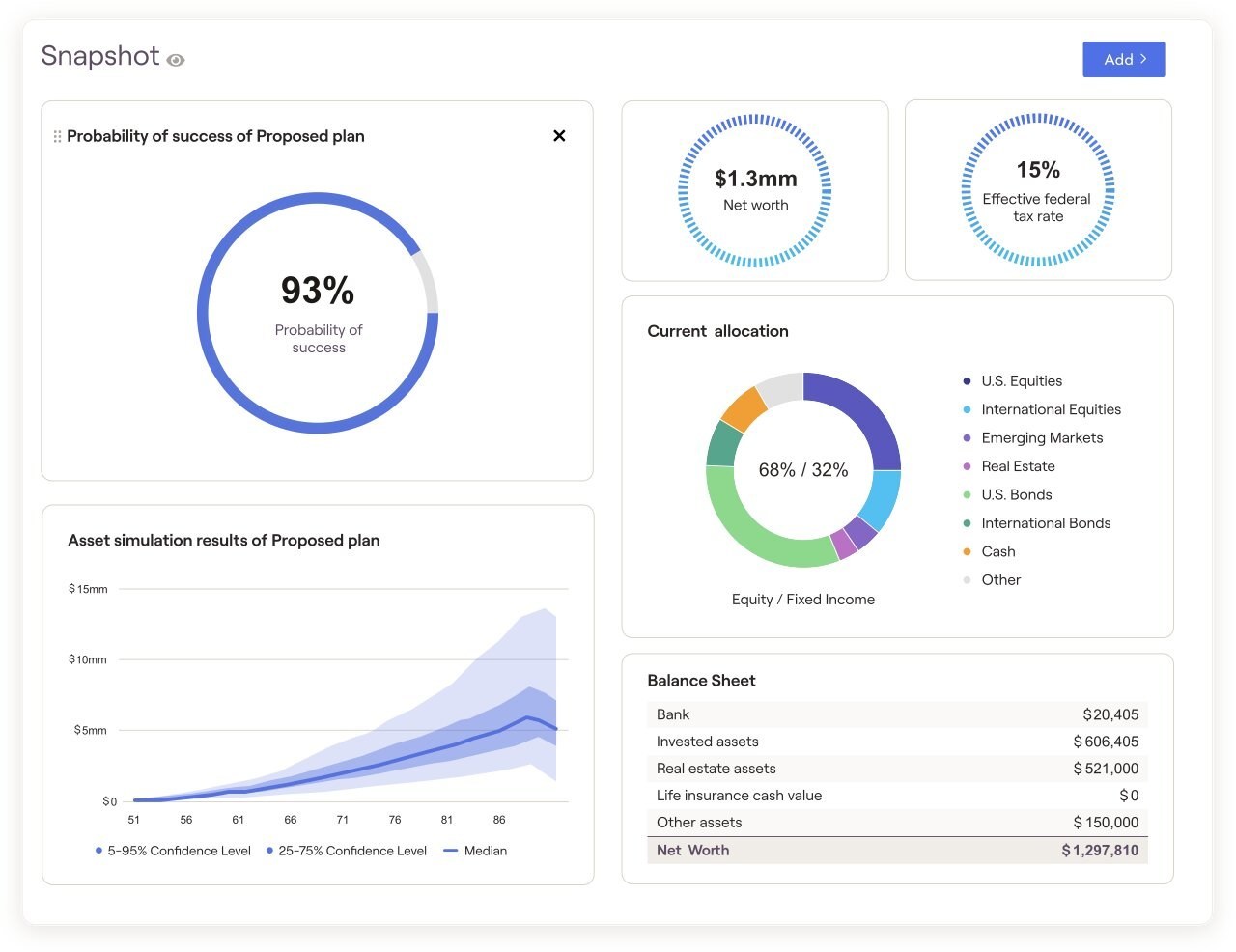

- Developing a custom asset allocation based on your specific goals

- Diversifying across various investment types and asset classes

- Establishing an appropriate level of risk/reward to help balance

growth potential while reducing potential losses - Implementing a disciplined strategy to help remove emotion from

the decision-making process - Identifying opportunities to improve the tax efficiency of a portfolio, such as tax loss harvesting, charitable giving and asset location strategies (putting non-tax-efficient assets in tax-efficient accounts and tax-efficient assets in taxable accounts)

No strategy assures success or protects against loss. Asset allocation does not ensure a profit or protect against loss. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio.

Diversification does not protect against market risk. WealthOne Advisors and LPL Financial do not provide tax advice or services. Please consult your tax advisor regarding your specific situation.

Ready to Get Started?

Contact me to schedule a 15-minute conversation.