We Serve Our Clients

We serve a wide range of clients with unique financial challenges.

Retirees

The financial planning process doesn’t end when you reach retirement. We help retirees maximize their monthly income, reduce their taxes and leave a legacy for the people and causes that matter most.

We begin by establishing a tax-efficient withdrawal strategy to support your short- and long-term needs in retirement. We conduct a thorough review of your pension and Social Security benefits to establish a distribution strategy that takes into consideration your retirement goals, life expectancy, family situation, income requirements and more.

We help you plan for your legacy goals by working with your estate planning attorney to implement any necessary legal documents and trusts. We can also help you optimize your charitable giving strategy if your goals include philanthropic objectives.

We monitor and adjust your retirement strategy throughout your lifetime to help support your ever-evolving life, retirement and legacy goals.

Pre-Retirees

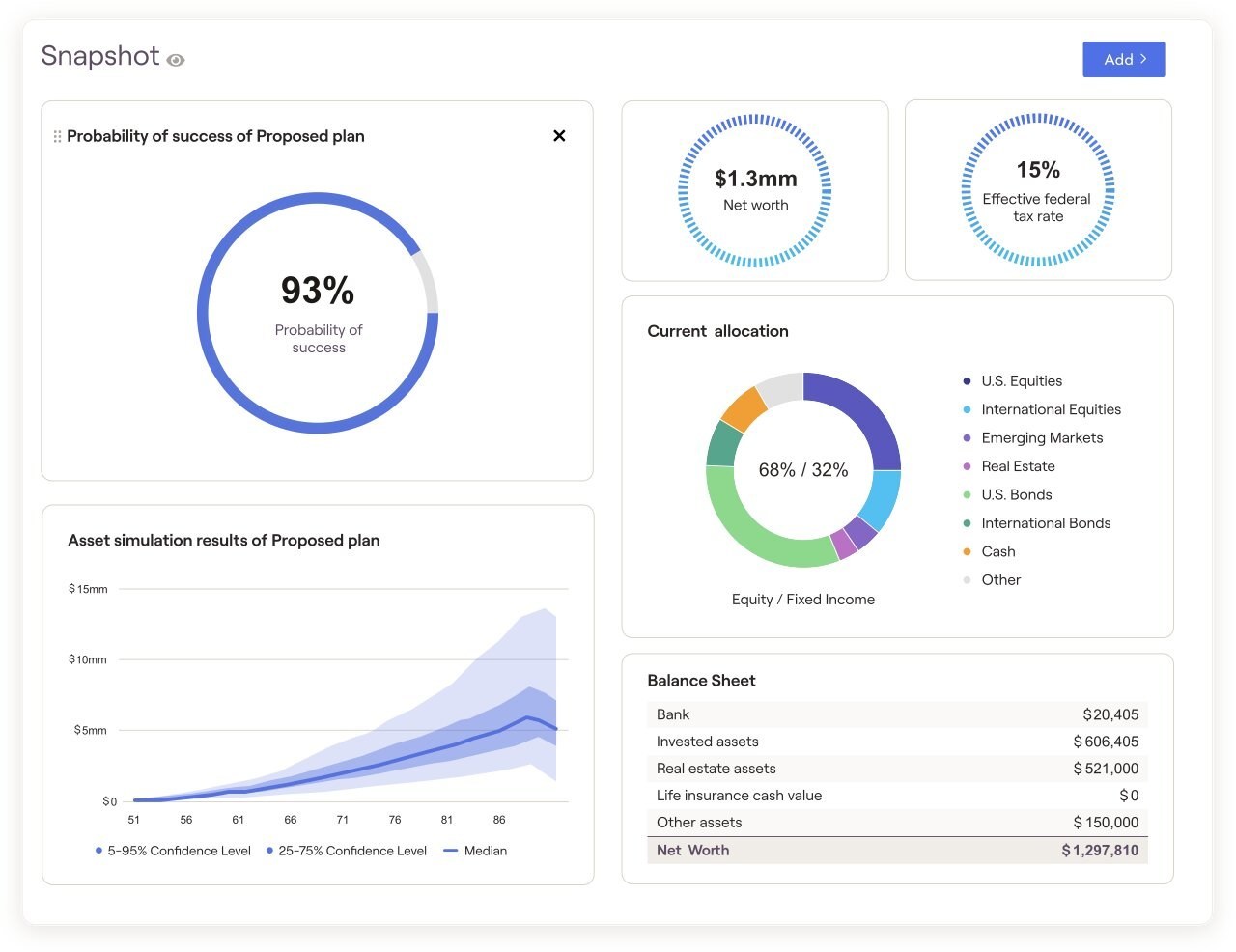

As you near retirement, you may begin to wonder, “Do I have enough savings to last a lifetime?” “How do I make the shift from saving to spending?” “Will my family be okay?” We help answer your most pressing questions so you can retire with confidence.

We begin by working with you to create a custom retirement plan designed to help you work towards achieving your goals. We use this plan to guide decisions related to saving, investing and more.

As you near retirement, we identify opportunities to establish a stream of monthly income to support your daily living expenses. We also begin shifting your portfolio from primarily growth-focused to income-focused, based on your specific retirement timeline and risk tolerance.

Surviving Spouses

When dealing with the loss of a loved one, it’s important to have a professional advisor who can guide your finances and ease your emotional stress.

Losing a spouse is the number one most stressful life event a person can experience. Yet, in the midst of your emotional grief, there are several important financial tasks that must be addressed. At WealthOne Advisors, we understand the challenges faced by those who have lost a spouse, and we help alleviate the stress of sorting out your finances and preparing for your new normal.

Our services often include helping surviving spouses:

- Obtain and distribute copies of necessary documentation, such as a certified death certificate and certificate of appointment to act as personal representative (if required by the state).

- Notify banks, credit card issuers and major credit bureaus of the spouse’s death in order to prevent fraud.

- Understand their current financial situation, including cash flow, expenses and assets in order to identify any potential budget shortfalls.

- Navigate how the death may impact Social Security benefits, pension payments, etc.

- Update accounts and titles, and modify beneficiaries as necessary.

- Navigate any life insurance payouts.

- Develop a plan for paying down outstanding medical bills, if applicable.

Beneficiaries

Our experienced professionals can help navigate the challenges of sudden wealth from an inheritance or other financial windfall.

Being the beneficiary of a large financial windfall can bring up many emotions. While the benefits of additional assets have the potential to improve your life, you may also be struggling with strong emotions if the windfall was due to inheriting assets following the death of a loved one.

At WealthOne Advisors, we have experience helping clients navigate the financial and emotional challenges of sudden wealth. We help you make decisions to reduce your tax liability and identify the right path forward. We also incorporate your new assets into your overall financial plan, help you with your own estate planning goals and identify charitable giving opportunities, if “paying it forward” is one of your objectives.

Self-Employed Business Owners

When it comes to navigating their personal and professional finances, self-employed individuals face unique complexities. Not only do you want to provide for your family, you5 also want to provide for your employees and support your company’s growth. At WealthOne Advisors, we help business owners solve a wide range of retirement challenges by helping them navigate:

- SEP IRAs

- Simple IRAs

- Solo 401(k)

- Roth 401(k)

- Defined Benefit Plans

We Serve Our Clients

We serve a wide range of clients with unique financial challenges.

Retirees

The financial planning process doesn’t end when you reach retirement. We help retirees maximize their monthly income, reduce their taxes and leave a legacy for the people and causes that matter most.

We begin by establishing a tax-efficient withdrawal strategy to support your short- and long-term needs in retirement. We conduct a thorough review of your pension and Social Security benefits to establish a distribution strategy that takes into consideration your retirement goals, life expectancy, family situation, income requirements and more.

We help you plan for your legacy goals by working with your estate planning attorney to implement any necessary legal documents and trusts. We can also help you optimize your charitable giving strategy if your goals include philanthropic objectives.

We monitor and adjust your retirement strategy throughout your lifetime to help support your ever-evolving life, retirement and legacy goals.

Pre-Retirees

As you near retirement, you may begin to wonder, “Do I have enough savings to last a lifetime?” “How do I make the shift from saving to spending?” “Will my family be okay?” We help answer your most pressing questions so you can retire with confidence.

We begin by working with you to create a custom retirement plan designed to help you work towards achieving your goals. We use this plan to guide decisions related to saving, investing and more.

As you near retirement, we identify opportunities to establish a stream of monthly income to support your daily living expenses. We also begin shifting your portfolio from primarily growth-focused to income-focused, based on your specific retirement timeline and risk tolerance.

Surviving Spouses

When dealing with the loss of a loved one, it’s important to have a professional advisor who can guide your finances and ease your emotional stress.

Losing a spouse is the number one most stressful life event a person can experience. Yet, in the midst of your emotional grief, there are several important financial tasks that must be addressed. At WealthOne Advisors, we understand the challenges faced by those who have lost a spouse, and we help alleviate the stress of sorting out your finances and preparing for your new normal.

Our services often include helping surviving spouses:

- Obtain and distribute copies of necessary documentation, such as a certified death certificate and certificate of appointment to act as personal representative (if required by the state).

- Notify banks, credit card issuers and major credit bureaus of the spouse’s death in order to prevent fraud.

- Understand their current financial situation, including cash flow, expenses and assets in order to identify any potential budget shortfalls.

- Navigate how the death may impact Social Security benefits, pension payments, etc.

- Update accounts and titles, and modify beneficiaries as necessary.

- Navigate any life insurance payouts.

- Develop a plan for paying down outstanding medical bills, if applicable.

Beneficiaries

Our experienced professionals can help navigate the challenges of sudden wealth from an inheritance or other financial windfall.

Being the beneficiary of a large financial windfall can bring up many emotions. While the benefits of additional assets have the potential to improve your life, you may also be struggling with strong emotions if the windfall was due to inheriting assets following the death of a loved one.

At WealthOne Advisors, we have experience helping clients navigate the financial and emotional challenges of sudden wealth. We help you make decisions to reduce your tax liability and identify the right path forward. We also incorporate your new assets into your overall financial plan, help you with your own estate planning goals and identify charitable giving opportunities, if “paying it forward” is one of your objectives.

Self-Employed Business Owners

When it comes to navigating their personal and professional finances, self-employed individuals face unique complexities. Not only do you want to provide for your family, you5 also want to provide for your employees and support your company’s growth. At WealthOne Advisors, we help business owners solve a wide range of retirement challenges by helping them navigate:

- SEP IRAs

- Simple IRAs

- Solo 401(k)

- Roth 401(k)

- Defined Benefit Plans